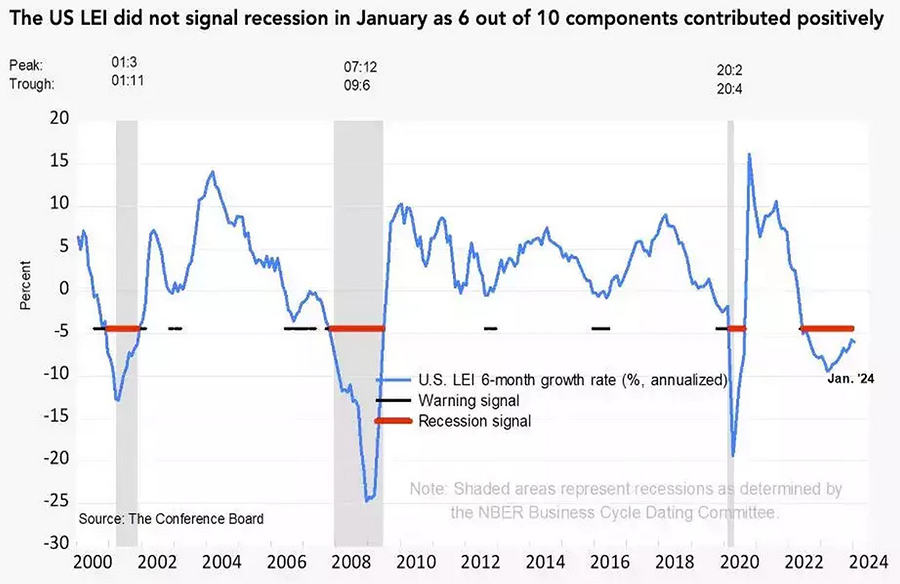

A longstanding harbinger of economic shifts, the Leading Economic Index (LEI) has been casting a shadow of concern for almost two years, sparking worries about an impending economic downturn.

What Does the LEI Indicate?

The LEI serves as an early-warning system, often forecasting economic peaks and troughs approximately seven months in advance. Compiled by The Conference Board, a non-profit think tank, this composite index amalgamates data from ten key indicators, providing insights into various facets of the economy:

- S&P 500 Index: Reflects market sentiment regarding corporate profits and economic growth.

- Leading Credit Index: Analyzes debt-related metrics to assess future borrowing conditions and financial health.

- Interest-Rate Spread: Compares long-term and short-term interest rates, offering clues about future borrowing costs and economic expectations.

- Average Weekly Hours of Manufacturing Workers: Indicates labor-market demand.

- Manufacturers’ New Orders: Reflects consumer spending and business investment trends.

- Institute for Supply Management’s Index of New Orders: Provides further insight into manufacturing activity.

- Manufacturers’ New Orders for Non-Defense Capital Goods: Excluding Aircraft: Offers additional data on business investment.

- Average Weekly Initial Applications for Unemployment Insurance: Tracks changes in joblessness.

- Building Permits for New Private Housing Units: Measures construction activity and housing demand.

- Average Consumer Expectations for Business Conditions: Surveys consumer and business confidence levels, aiding in predicting future spending and investment trends.

Interpretation of the LEI

The LEI integrates these indicators to provide a comprehensive view of the economy’s trajectory across multiple dimensions, encompassing growth, employment, consumer demand, and housing activity. For instance, changes in the S&P 500 anticipate shifts in corporate performance, while variations in unemployment claims gauge labor-market conditions.

Insights from Market Veterans

Notable investors and economists, including David Rosenberg, Jeremy Grantham, Jeffrey Gundlach, and Gary Shilling, have highlighted the LEI’s extended decline as a forewarning of an impending recession. They argue that such prolonged downturns historically precede economic contractions.

Contrasting Views

While the LEI’s accuracy in predicting recessions is well-documented, some experts caution against over-reliance on its signals. Criticisms include its heavy emphasis on manufacturing in a service-driven economy and potential distortions due to the pandemic. Despite recent improvements in several components, concerns persist regarding future economic growth.

Conclusion

While the LEI’s predictive power is subject to debate, its historical significance warrants close attention. As investors and policymakers navigate uncertain economic terrain, monitoring the Leading Economic Index remains crucial for anticipating potential shifts in the economic landscape.