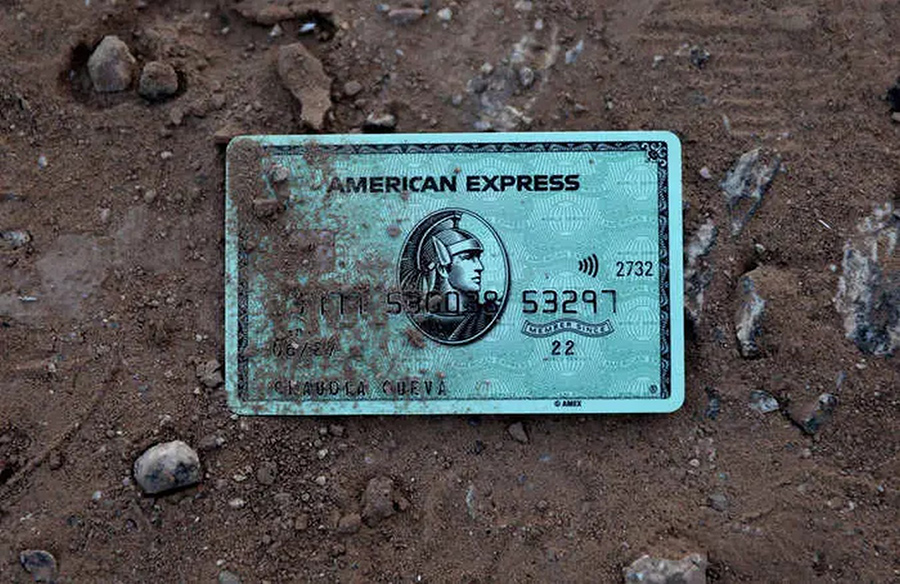

As consumer spending buoyed the US economy through 2023, underlying cracks in financial stability began to emerge, with record levels of credit card debt signaling potential trouble ahead. Amid soaring interest rates and escalating delinquencies, Americans are grappling with the implications of a looming credit card crisis.

Growing Debt, Escalating Concerns

Recent data from Money Management International (MMI) underscores the severity of the situation, revealing a surge in debt-related counseling inquiries following the holiday season. Of particular concern are individuals in their 20s, Gen Z, and younger millennials, whose representation among counseling cases has notably increased, signaling a shift in debt dynamics.

Alarming Trends in Household Debt

The Federal Reserve Bank of New York reports a substantial surge in total household debt, reaching $17.5 trillion, with credit card balances experiencing the most significant growth. A staggering $1.13 trillion in credit card debt underscores the magnitude of the challenge, with balances rising consistently over several quarters.

Delinquencies on the Rise

Compounding the issue is a marked increase in delinquency rates, with over 6% of credit card balances now classified as seriously delinquent. This trend, highlighted by Ginger Chambless of JPMorgan Chase, represents a departure from previous mortgage-related delinquencies, signaling a shift in debt dynamics and financial vulnerability.

Impact of Interest Rates

Exacerbating the credit card crisis is the surge in interest rates, fueled by Federal Reserve rate hikes aimed at curbing inflation. With rates exceeding 30% in some cases, the average American faces a significant financial burden, spending approximately $1,140 annually on credit card interest and fees alone.

Emergence of “Phantom Debt”

Adding complexity to the situation is the growing prevalence of buy now, pay later (BNPL) payment plans, which often go unreported to credit agencies. While these plans offer an alternative to traditional credit cards, they contribute to mounting consumer debt, posing challenges for financial stability.

Outlook: Navigating Uncertain Terrain

While concerns about a full-blown recession persist, the credit card crisis underscores broader vulnerabilities within the economy. While parallels to the mortgage crisis of the late 2000s exist, key differences, such as robust employment and rising wages, mitigate some risks. Nonetheless, the path to economic recovery remains uncertain, with the resilience of consumer spending facing significant challenges.