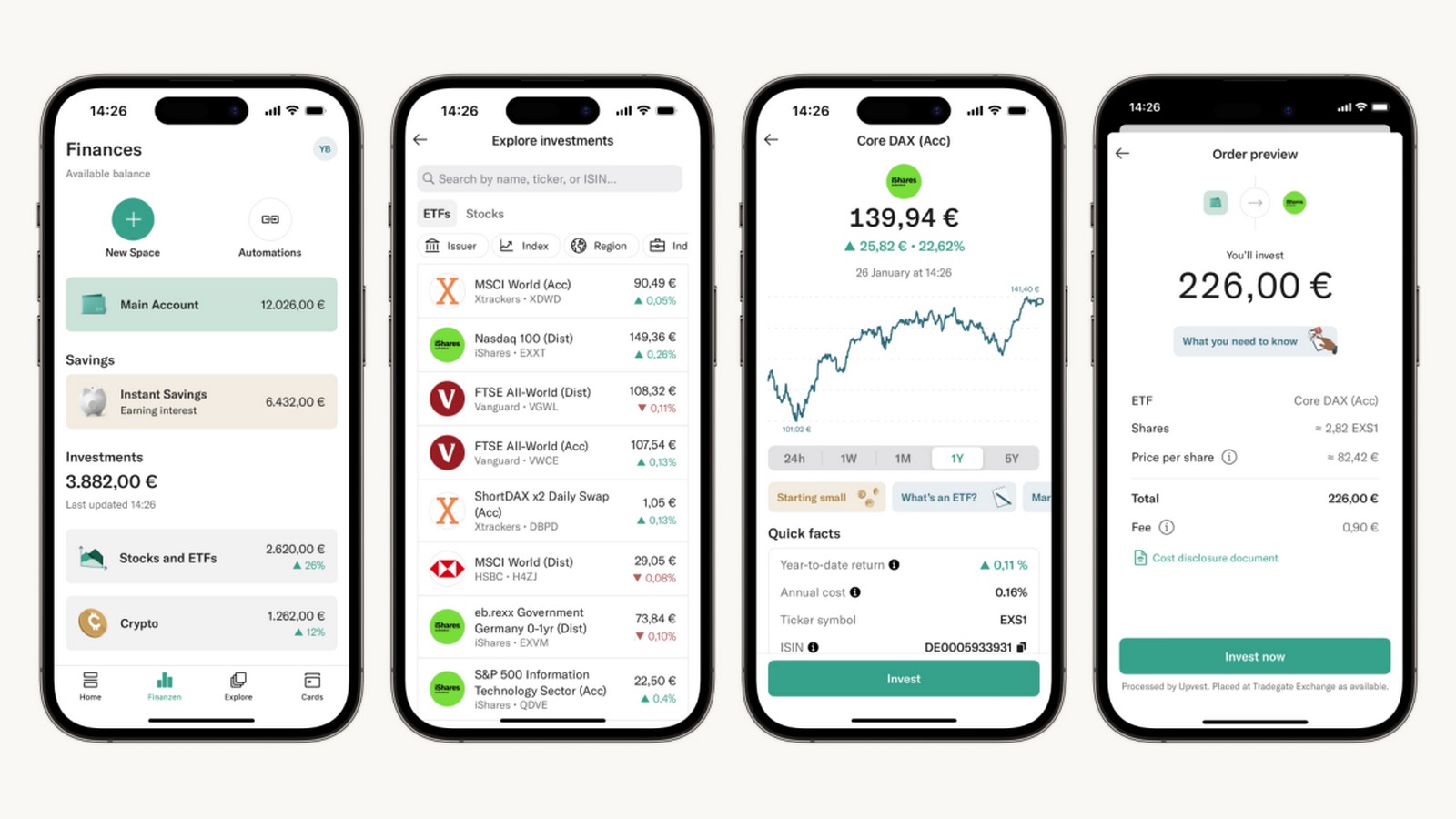

Berlin-based banking startup N26 is expanding its offerings with the launch of a new stock and ETF trading feature, starting in Austria. This move signals a strategic shift towards offering a broader range of banking products in its core markets.

Evolution of N26

Initially known for its user-friendly mobile banking app and real-time card management features, N26 has steadily expanded its product lineup since its inception. With a focus on efficiency and profitability, the company has honed in on its core markets, including Germany, France, Spain, and Italy, after previously venturing into the U.S. and Brazil.

Regulatory Challenges and Strategic Focus

Regulatory scrutiny, particularly from Germany’s financial regulator BaFin, prompted N26 to reevaluate its expansion strategy. BaFin imposed restrictions on client signups, limiting N26 to accepting only 60,000 new clients per month. In response, N26 intensified its anti-money laundering efforts and refocused its efforts on European markets.

Revenue Diversification through Stock Trading

To drive revenue growth and increase average revenue per user, N26 is introducing stock and ETF trading in partnership with Upvest. This feature allows users to invest in fractional shares of stocks and ETFs, with trading fees starting at €0.90 per trade. Premium customers will receive complimentary trades based on their subscription plan.

Expansion Plans and Financial Performance

While the initial rollout is in Austria, N26 plans to expand trading services to Germany and other European countries in the coming months. The introduction of stock trading complements N26’s existing offerings, including savings accounts, loans, and crypto trading, positioning it as a comprehensive banking solution.

Path to Profitability

Despite reporting a loss of €100 million in 2023, N26 has made significant strides towards profitability. With a focus on cost optimization and revenue generation, the company aims to achieve profitability on a monthly basis by the end of the year.

Conclusion

As N26 continues to enhance its banking platform and broaden its financial services, it seeks to consolidate its position as a leading challenger bank in Europe. The introduction of stock and ETF trading underscores N26’s commitment to meeting the evolving needs of its customers while driving sustainable growth in the fintech industry.