Sharing finances can be daunting, especially for couples who haven’t tied the knot yet but are already living together. Recognizing this challenge, Michelle Winterfield and Daniel Couvreur embarked on a mission to create an app tailored to what they call “the modern couple.” Thus, Tandem was born, offering a fintech solution that addresses the financial milestones of couples and adapts to their evolving relationship dynamics.

Simplifying Financial Management

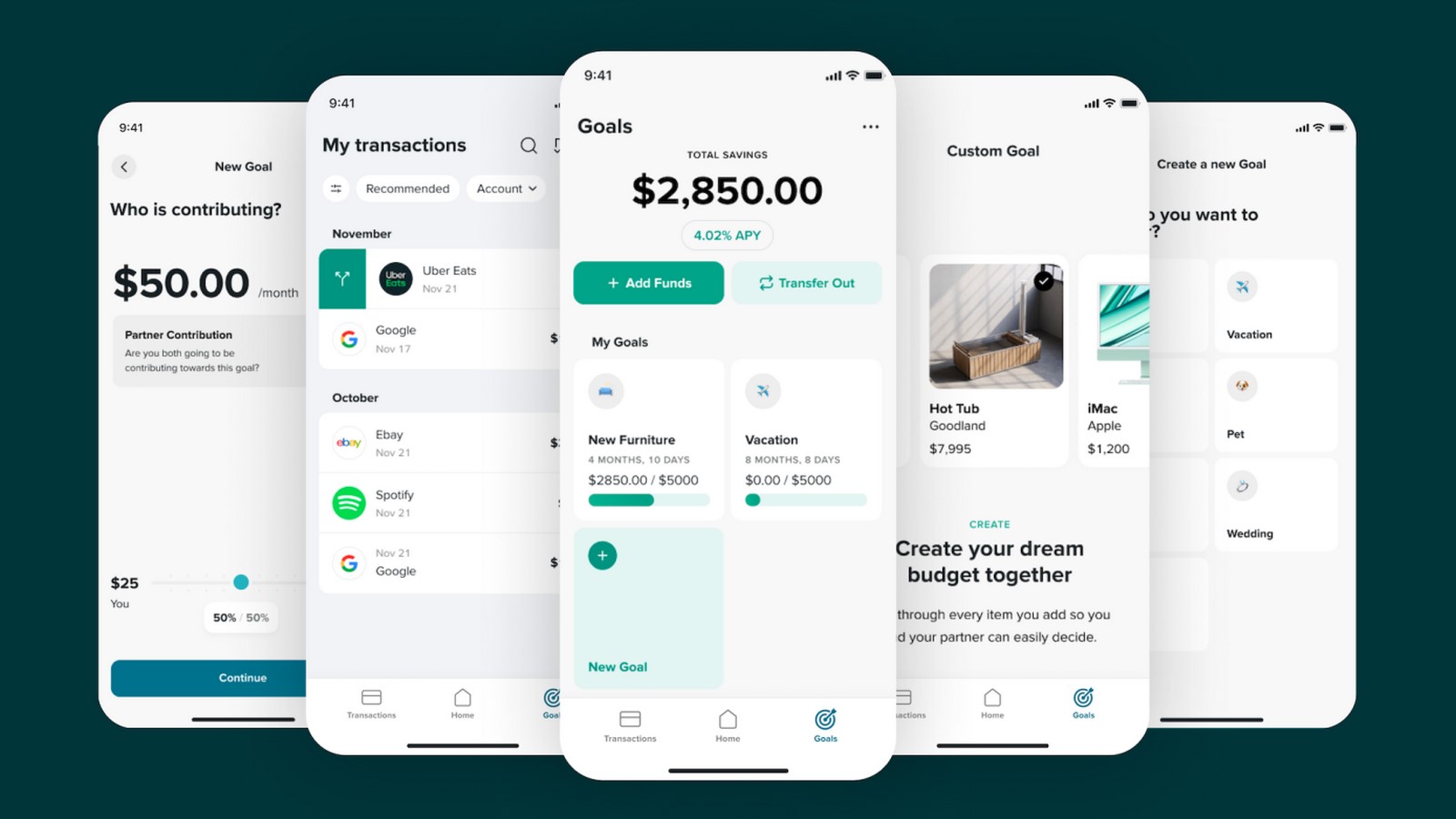

Tandem streamlines financial management for couples by facilitating planning, saving, and spending through its subscription-based app. The platform allows users to set up in minutes, inviting their partners to connect their credit or debit cards. Tandem then aggregates transactions, ensuring each partner only sees what the other chooses to share. Couples can automate money transfers for shared expenses, eliminating the need for a joint account while providing the convenience of centralized financial management.

User Experience and Growth

With over 25,000 couples onboard, Tandem has processed $60 million in expenses since its launch in August 2023. The platform offers a seamless experience, allowing couples to settle balances and manage shared expenses effortlessly. Recognizing its potential, investors injected $3.7 million into Tandem, led by Corazon Capital, with participation from individual investors and executives from prominent companies like OkCupid, Match Group, and Tinder.

Addressing Unique Challenges

Tandem’s innovative approach addresses the unique challenges faced by modern couples in managing their finances. While competitors focus on providing shared debit cards, Tandem emphasizes consumer-centric features and automation to alleviate financial burdens. The platform crowdsources feature ideas from its user base, with the latest addition being the “Goals” feature, enabling couples to plan and collaborate on shared purchases.

Future Growth and Expansion

The new capital infusion will fuel Tandem’s growth initiatives, including the launch of the “Goals” feature, marketing efforts, team expansion, and the development of an Android app. Tandem aims to provide a seamless, automated solution that fosters financial independence while nurturing shared life goals. With a focus on user experience and innovation, Tandem is poised to redefine financial management for modern couples.