Introduction

As we mark the tenth anniversary since the publication of “Welcome to the Unicorn Club,” it’s a fitting moment to examine the journey of unicorns over the past decade. In this reflective piece, we delve into the evolution of the unicorn ecosystem, exploring changes, trends, and what lies ahead for these remarkable ventures.

The Beginning: Setting the Stage in 2013

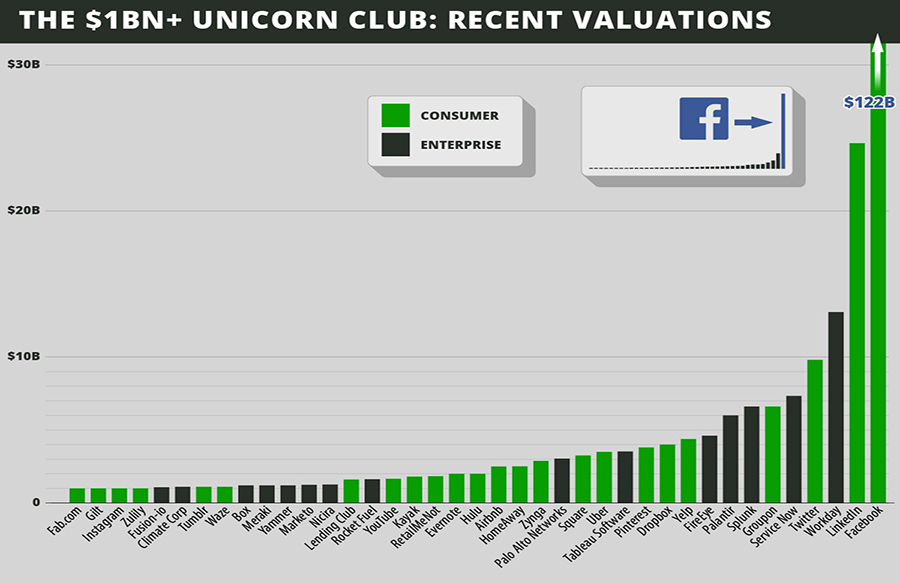

Back in 2013, Cowboy Ventures embarked on a journey to understand the phenomenon of unicorns, those rare startups valued at over $1 billion. With only 39 identified at the time, our analysis uncovered intriguing insights into their characteristics and trajectories.

A Decade of Growth: 2013 to 2023

The Rise of VC Funds and Valuations

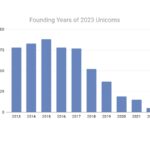

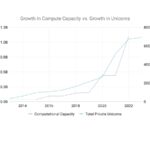

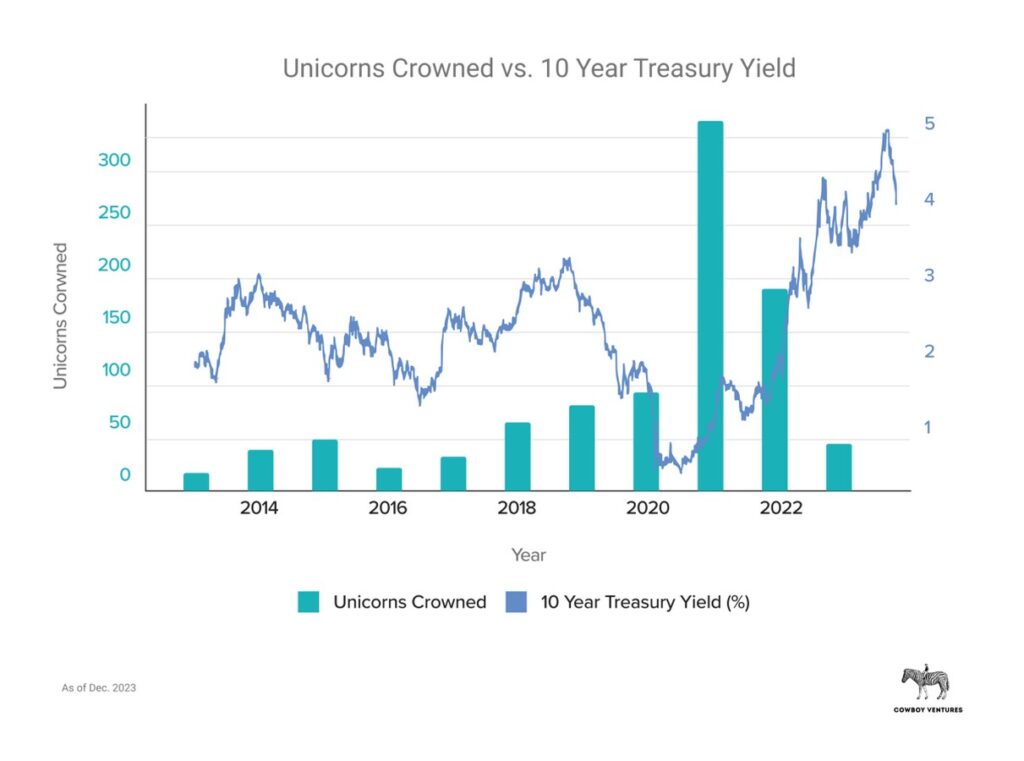

Over the span of ten years, the venture capital landscape underwent a seismic shift. With capital inflows tripling, fueled by burgeoning markets and low interest rates, the unicorn herd swelled to unprecedented numbers.

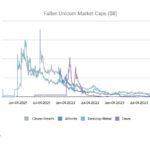

The Turn of the Tide

However, the winds of change began to blow in 2022 as the Federal Reserve raised interest rates. This ushered in a period of reckoning, with many unicorns facing down rounds, delistings, and closures amidst a more cautious investment climate.

A Closer Look at the 2023 Unicorn Club

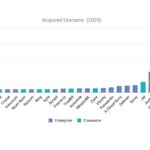

Ballooning Numbers and Sector Diversification

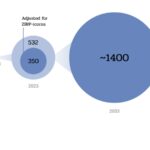

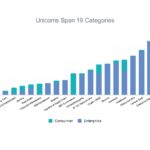

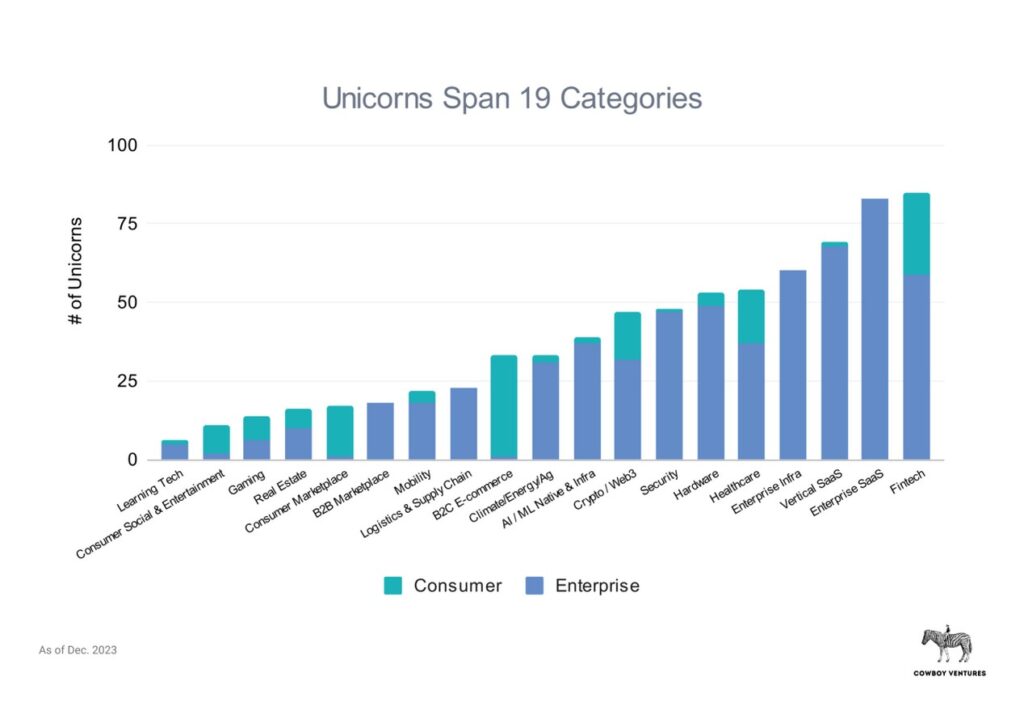

The unicorn population skyrocketed to 532, representing a 14x increase from 2013. Notably, these unicorns spanned a broader spectrum of sectors, reflecting the ever-expanding frontiers of innovation.

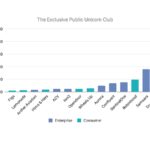

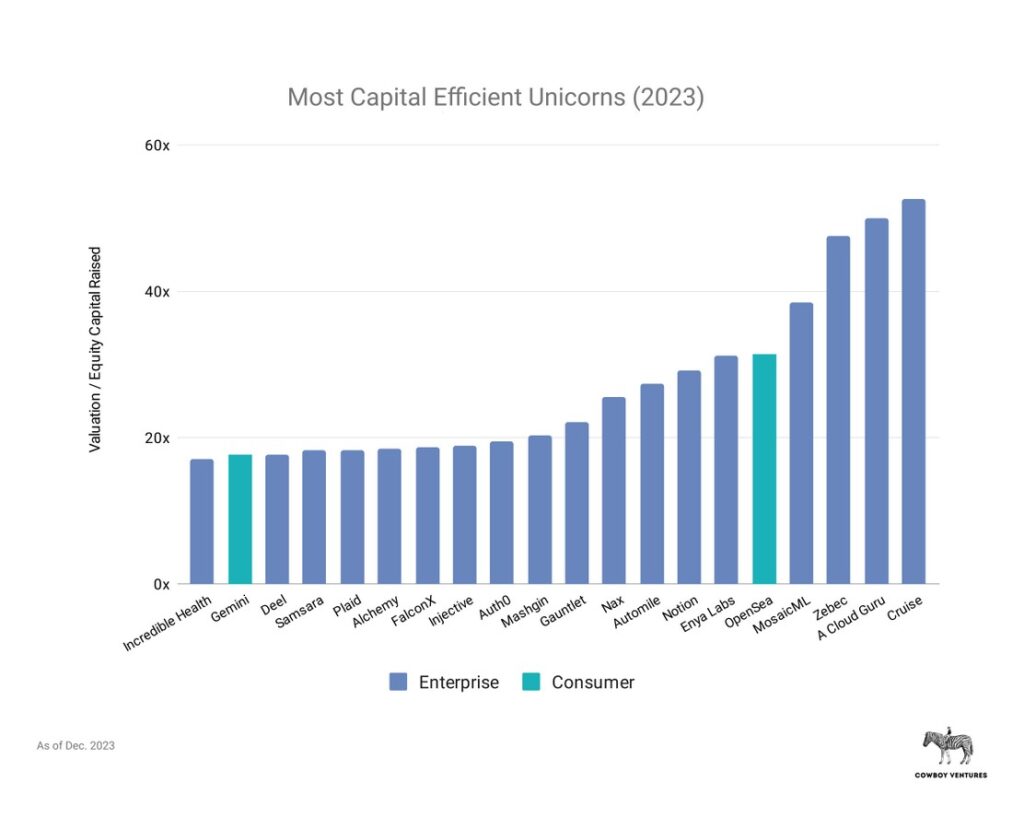

The Pendulum Swings to Enterprise

A notable shift occurred towards enterprise-focused ventures, which accounted for 78% of unicorns in 2023, a stark contrast to the consumer-centric landscape of a decade ago.

Challenges and Opportunities

However, beneath the surface lurked challenges. A significant portion of unicorns were “papercorns,” privately valued entities facing liquidity concerns. Moreover, many were dubbed “ZIRPicorns,” their last valuations inflated by near-zero interest rates, posing sustainability questions.

Lessons Learned and Future Outlook

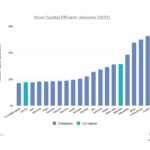

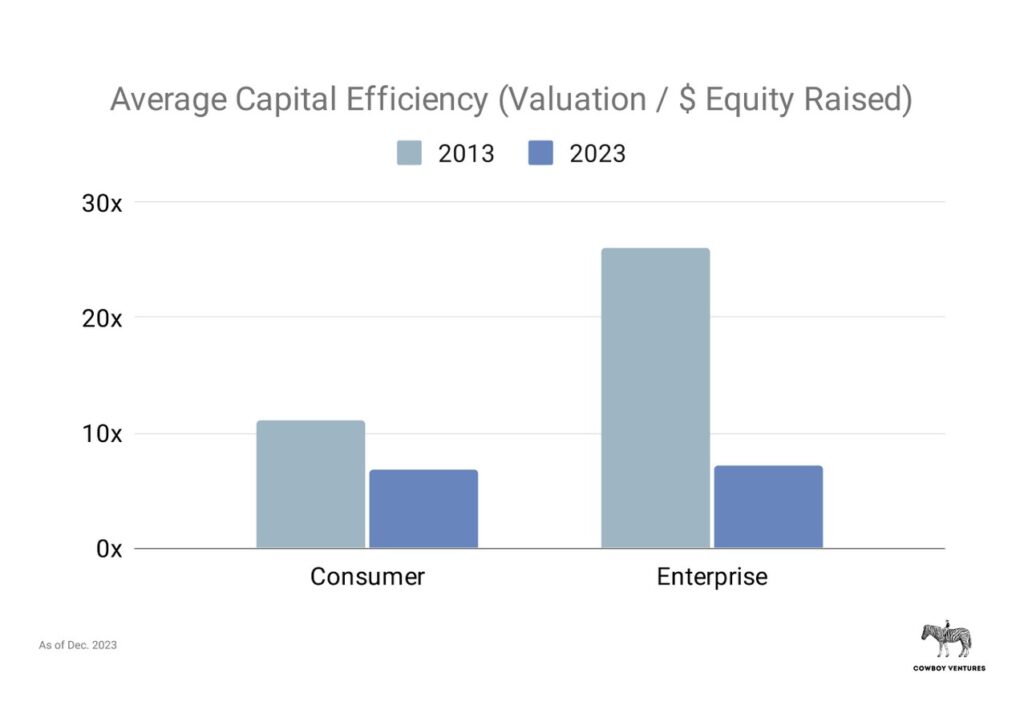

Capital Efficiency and Sustainable Growth

Capital efficiency emerged as a critical metric, with a decline observed over the decade. Sustainable growth models and prudent financial management became imperative for long-term success.

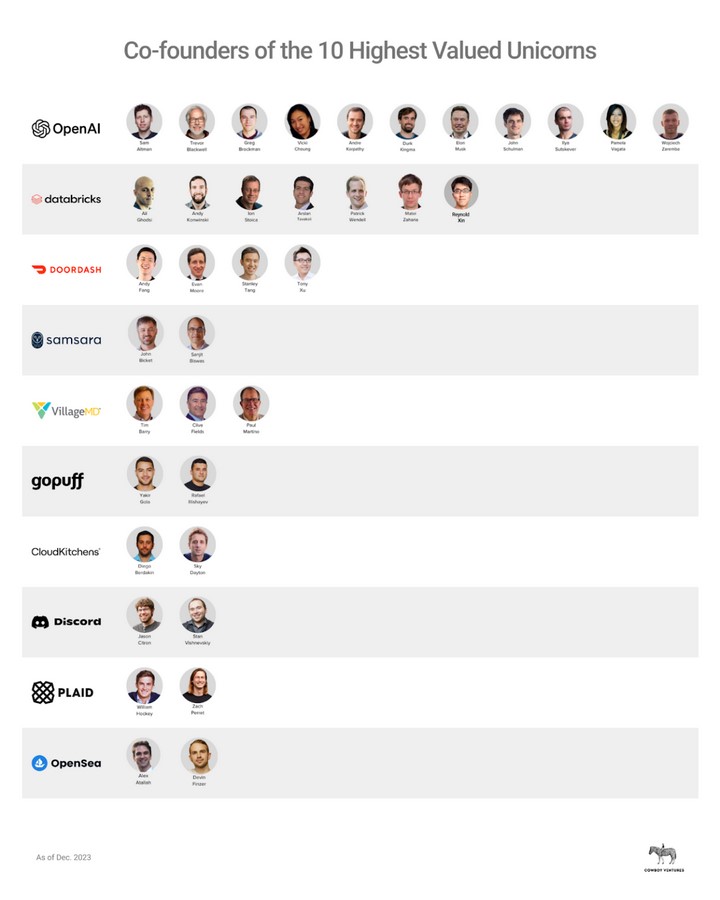

The Emergence of Superunicorns and Megatrends

Noteworthy among the unicorn cohort were the emergence of superunicorns, exemplified by the likes of Meta and potentially OpenAI. Moreover, AI stood out as a prominent megatrend poised to shape the next decade of innovation.

Changing Geographical Landscape and Diversity Imperatives

The geographical distribution of unicorns witnessed shifts, with hubs beyond the Bay Area gaining prominence. However, diversity, particularly gender representation, remained a pressing concern, necessitating concerted efforts for improvement.

Looking Ahead: Challenges and Opportunities

As we gaze into the future, uncertainty looms alongside boundless potential. While the unicorn ecosystem faces headwinds, technological advancements and entrepreneurial fervor promise a continued era of innovation and disruption.

Conclusion

In conclusion, the journey of unicorns over the past decade has been nothing short of remarkable. From humble beginnings to global juggernauts, these ventures have reshaped industries and economies alike. As we navigate the ever-evolving landscape of entrepreneurship, one thing remains clear: the allure of the unicorn club persists, beckoning forth the next wave of visionary founders and transformative innovations.